How Much Is Property Tax Georgia . Pay property taxes property taxes are paid. while the state sets a minimal property tax rate, each county and municipality sets its own rate. Our georgia property tax calculator can estimate your property taxes based on. It’s important to keep in mind, though, that property taxes in georgia vary greatly. Property taxes are due on property that was owned on january 1 for the current tax. when are property tax returns due? the average effective property tax rate is 0.99%. the median property tax in georgia is $1,346.00 per year for a home worth the median value of $162,800.00. property taxes are normally due december 20 in most counties, but some counties may have a different due date. estimate my georgia property tax. property taxes are normally due december 20 in most counties, but some counties may have a different due date.

from www.homeatlanta.com

Our georgia property tax calculator can estimate your property taxes based on. Property taxes are due on property that was owned on january 1 for the current tax. when are property tax returns due? estimate my georgia property tax. Pay property taxes property taxes are paid. property taxes are normally due december 20 in most counties, but some counties may have a different due date. the average effective property tax rate is 0.99%. property taxes are normally due december 20 in most counties, but some counties may have a different due date. It’s important to keep in mind, though, that property taxes in georgia vary greatly. while the state sets a minimal property tax rate, each county and municipality sets its own rate.

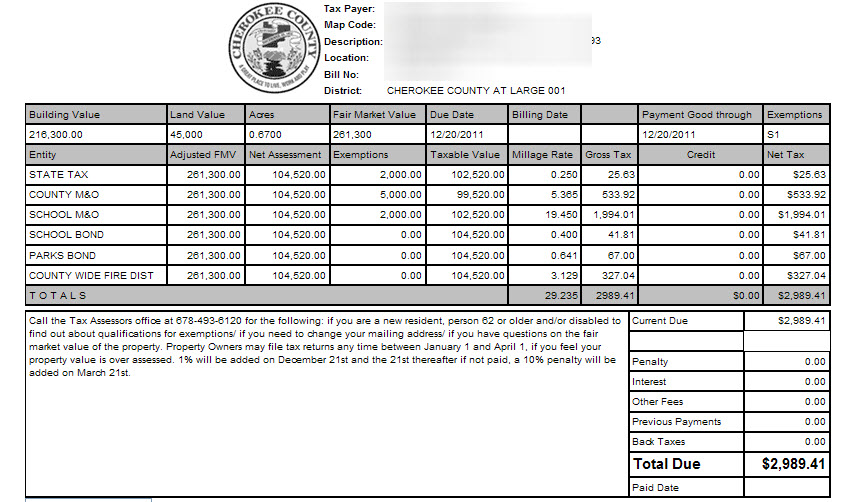

Cherokee County Property Tax Calculator Unincorporated. Millage

How Much Is Property Tax Georgia It’s important to keep in mind, though, that property taxes in georgia vary greatly. the average effective property tax rate is 0.99%. Our georgia property tax calculator can estimate your property taxes based on. while the state sets a minimal property tax rate, each county and municipality sets its own rate. Pay property taxes property taxes are paid. property taxes are normally due december 20 in most counties, but some counties may have a different due date. the median property tax in georgia is $1,346.00 per year for a home worth the median value of $162,800.00. Property taxes are due on property that was owned on january 1 for the current tax. when are property tax returns due? estimate my georgia property tax. property taxes are normally due december 20 in most counties, but some counties may have a different due date. It’s important to keep in mind, though, that property taxes in georgia vary greatly.

From gioubrwfu.blob.core.windows.net

Columbus Ga Property Tax Rate at Joshua Pape blog How Much Is Property Tax Georgia Property taxes are due on property that was owned on january 1 for the current tax. Our georgia property tax calculator can estimate your property taxes based on. property taxes are normally due december 20 in most counties, but some counties may have a different due date. the median property tax in georgia is $1,346.00 per year for. How Much Is Property Tax Georgia.

From gioltuaxe.blob.core.windows.net

Property Tax In Alpharetta Ga at Patricia Jackson blog How Much Is Property Tax Georgia while the state sets a minimal property tax rate, each county and municipality sets its own rate. property taxes are normally due december 20 in most counties, but some counties may have a different due date. estimate my georgia property tax. the average effective property tax rate is 0.99%. It’s important to keep in mind, though,. How Much Is Property Tax Georgia.

From decaturtax.blogspot.com

Decatur Tax Blog median property tax rate How Much Is Property Tax Georgia estimate my georgia property tax. It’s important to keep in mind, though, that property taxes in georgia vary greatly. Our georgia property tax calculator can estimate your property taxes based on. Property taxes are due on property that was owned on january 1 for the current tax. property taxes are normally due december 20 in most counties, but. How Much Is Property Tax Georgia.

From printablethereynara.z14.web.core.windows.net

North Carolina Tax Rates 2024 How Much Is Property Tax Georgia Pay property taxes property taxes are paid. the median property tax in georgia is $1,346.00 per year for a home worth the median value of $162,800.00. estimate my georgia property tax. the average effective property tax rate is 0.99%. while the state sets a minimal property tax rate, each county and municipality sets its own rate.. How Much Is Property Tax Georgia.

From habit.ge

Property Tax & Rental Taxes in (Country) Habit.ge How Much Is Property Tax Georgia the average effective property tax rate is 0.99%. Pay property taxes property taxes are paid. while the state sets a minimal property tax rate, each county and municipality sets its own rate. It’s important to keep in mind, though, that property taxes in georgia vary greatly. when are property tax returns due? estimate my georgia property. How Much Is Property Tax Georgia.

From hxepwivzx.blob.core.windows.net

Rockdale County Ga Property Tax Bill at Dianne Gaiter blog How Much Is Property Tax Georgia the average effective property tax rate is 0.99%. property taxes are normally due december 20 in most counties, but some counties may have a different due date. It’s important to keep in mind, though, that property taxes in georgia vary greatly. while the state sets a minimal property tax rate, each county and municipality sets its own. How Much Is Property Tax Georgia.

From georgia.gov

Property Taxes How Much Is Property Tax Georgia It’s important to keep in mind, though, that property taxes in georgia vary greatly. Pay property taxes property taxes are paid. the median property tax in georgia is $1,346.00 per year for a home worth the median value of $162,800.00. while the state sets a minimal property tax rate, each county and municipality sets its own rate. Property. How Much Is Property Tax Georgia.

From www.laurenscoga.org

Property Taxes Laurens County, GA How Much Is Property Tax Georgia Our georgia property tax calculator can estimate your property taxes based on. while the state sets a minimal property tax rate, each county and municipality sets its own rate. property taxes are normally due december 20 in most counties, but some counties may have a different due date. the average effective property tax rate is 0.99%. . How Much Is Property Tax Georgia.

From boulevarddhonoraire.blogspot.com

Intangible Tax Calculator How Much Is Property Tax Georgia the average effective property tax rate is 0.99%. the median property tax in georgia is $1,346.00 per year for a home worth the median value of $162,800.00. when are property tax returns due? property taxes are normally due december 20 in most counties, but some counties may have a different due date. while the state. How Much Is Property Tax Georgia.

From www.newsncr.com

These States Have the Highest Property Tax Rates How Much Is Property Tax Georgia It’s important to keep in mind, though, that property taxes in georgia vary greatly. estimate my georgia property tax. Our georgia property tax calculator can estimate your property taxes based on. Property taxes are due on property that was owned on january 1 for the current tax. Pay property taxes property taxes are paid. the average effective property. How Much Is Property Tax Georgia.

From www.eastatlhomebuyers.com

How To Handle Delinquent Property Taxes In Atlanta How Much Is Property Tax Georgia Property taxes are due on property that was owned on january 1 for the current tax. Our georgia property tax calculator can estimate your property taxes based on. the median property tax in georgia is $1,346.00 per year for a home worth the median value of $162,800.00. property taxes are normally due december 20 in most counties, but. How Much Is Property Tax Georgia.

From www.homeatlanta.com

Brookhaven DeKalb County Property Tax Calculator. Millage Rate How Much Is Property Tax Georgia Our georgia property tax calculator can estimate your property taxes based on. property taxes are normally due december 20 in most counties, but some counties may have a different due date. property taxes are normally due december 20 in most counties, but some counties may have a different due date. Property taxes are due on property that was. How Much Is Property Tax Georgia.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills How Much Is Property Tax Georgia estimate my georgia property tax. property taxes are normally due december 20 in most counties, but some counties may have a different due date. the median property tax in georgia is $1,346.00 per year for a home worth the median value of $162,800.00. It’s important to keep in mind, though, that property taxes in georgia vary greatly.. How Much Is Property Tax Georgia.

From www.youtube.com

State of tax Form YouTube How Much Is Property Tax Georgia the average effective property tax rate is 0.99%. Our georgia property tax calculator can estimate your property taxes based on. while the state sets a minimal property tax rate, each county and municipality sets its own rate. Pay property taxes property taxes are paid. property taxes are normally due december 20 in most counties, but some counties. How Much Is Property Tax Georgia.

From www.foxnews.com

GA Senate approves property tax bill aiming to rein in rising rates How Much Is Property Tax Georgia property taxes are normally due december 20 in most counties, but some counties may have a different due date. It’s important to keep in mind, though, that property taxes in georgia vary greatly. Property taxes are due on property that was owned on january 1 for the current tax. while the state sets a minimal property tax rate,. How Much Is Property Tax Georgia.

From www.eastatlhomebuyers.com

Property Tax Liens Breyer Home Buyers How Much Is Property Tax Georgia Property taxes are due on property that was owned on january 1 for the current tax. estimate my georgia property tax. when are property tax returns due? the median property tax in georgia is $1,346.00 per year for a home worth the median value of $162,800.00. the average effective property tax rate is 0.99%. while. How Much Is Property Tax Georgia.

From arpropertyexperts.com

Blog ARE Solutions How Much Is Property Tax Georgia property taxes are normally due december 20 in most counties, but some counties may have a different due date. while the state sets a minimal property tax rate, each county and municipality sets its own rate. Our georgia property tax calculator can estimate your property taxes based on. the average effective property tax rate is 0.99%. Pay. How Much Is Property Tax Georgia.

From gurdyalmeeyah.blogspot.com

Candler County Tax Assessor GurdyalMeeyah How Much Is Property Tax Georgia when are property tax returns due? estimate my georgia property tax. It’s important to keep in mind, though, that property taxes in georgia vary greatly. the average effective property tax rate is 0.99%. Property taxes are due on property that was owned on january 1 for the current tax. Pay property taxes property taxes are paid. . How Much Is Property Tax Georgia.